-

1/1/2026

1/1/2026Introducing the DeductAble Web App

Great news for DeductAble users: You can now track your charitable donations directly from your web browser. Whether youre at your desk, on a Chromebook, or simply prefer a larger screen — DeductAbles full-featured web app is live and ready for you at app.deductable.ai. Why a Web App? Since launching DeductAble on iOS, one of

-

12/14/2025

12/14/2025Navigating the Noncash Charitable Contributions Limit

Donating things you no longer need is a great way to support the causes you believe in and maximize your itemized tax deductions. But to get the most out of your generosity at tax time, you need to understand the noncash charitable contributions limit. This isnt some arbitrary dollar amount. The IRS caps your deduction

-

12/5/2025

12/5/2025Are Funeral Expenses Tax Deductible?

Lets get straight to the point: funeral expenses are almost never tax-deductible on your personal tax return. The IRS sees these costs as a personal expense, plain and simple. That means you cant claim them on your Form 1040, no matter how significant the financial strain. Are Funeral Expenses Tax Deductible While you can’t write

11/1/2025

How to Maximize Your Tax Deduction When Donating a Car to Charity

Donating your car is a fantastic way to support a cause you love, and it can come with a significant tax benefit. But the process—and the size of your deduction—pivots on one key number: $500. This figure determines whether your deduction is based on the car's Fair Market Value or what the charity actually sells it for. Understanding this rule from the start is the key to maximizing your tax savings and making your generosity count.

Your Guide to Car Donations and Maximizing Tax Savings

Turning an old car, truck, or boat into a meaningful contribution feels great. On top of that, donating your car to charity can directly lower your taxable income if you itemize. But to secure that financial benefit, you have to follow IRS rules, which can feel tricky. This guide will walk you through everything, step-by-step, so you can confidently claim the maximum deduction you're entitled to.

The process begins the moment you select a legitimate 501(c)(3) organization and doesn't end until you file your return. Your best friend through it all? Meticulous records. From the tow-truck driver's receipt to the final tax forms the charity sends, every document is a crucial piece of evidence for your deduction.

How an Itemized Deduction Works

For many donors, the tax deduction is a powerful incentive. Here's the core concept: if the charity sells your car for more than $500, you can deduct that exact sale price. If it sells for less, you can deduct its Fair Market Value, but that deduction is capped at $500. As you can see, this distinction can make a real difference in your final tax bill.

To claim this benefit, you must itemize deductions on your tax return. This is a critical point. It only makes financial sense if the total of all your itemized deductions—including your car donation, mortgage interest, state and local taxes, and other charitable gifts—exceeds the standard deduction for the tax year. You can dig deeper into how car donation tax rules may apply in 2025.

The IRS has very specific rules about how much you can deduct. I've broken down the basics in the table below.

Car Donation Tax Deduction at a Glance

This table sums up the core IRS rules based on your vehicle's final selling price.

| If Your Car Sells For… | Your Maximum Deduction Is… | Required IRS Form from Charity |

|---|---|---|

| Under $500 | The Fair Market Value, up to $500. | A written acknowledgment (receipt). |

| Over $500 | The exact gross sale price. | Form 1098-C (or similar statement). |

Remember, it's the charity's responsibility to provide you with the correct form within 30 days of the sale. If you haven't received it, follow up! This paperwork is non-negotiable proof for the IRS.

How to Choose the Right Charity and Avoid Scams

Deciding where your old car goes is the single most important part of this process. It’s not just about picking a cause you believe in; it’s about making sure your generosity actually counts—both for the charity and for your tax return.

A great donation to a fraudulent operator can mean zero tax benefit for you. Worse, it leaves you with the sinking feeling that your goodwill was exploited.

The good news? A little due diligence goes a long way. You can feel confident you’re working with a reputable organization that aligns with your values and checks all the right boxes with the IRS. It all starts with one critical detail.

First Things First: Verify Their 501(c)(3) Status

Before you even think about handing over the keys, you must confirm the charity is a qualified 501(c)(3) organization. This is non-negotiable. Only donations to these specific, IRS-approved public charities are actually tax-deductible.

The IRS makes this surprisingly easy. Just use their online Tax Exempt Organization Search tool. Enter the charity’s name, and the database will tell you if it's in good standing. If you can’t find them, walk away. It’s a dead end for your tax deduction.

Key Takeaway: A legitimate charity will be proud of its 501(c)(3) status and won't hesitate if you ask about it. Not finding them in the official IRS database is the only red flag you need.

Look Beyond the Name and Ask the Tough Questions

Once you’ve confirmed a charity is the real deal, your next job is to figure out how they operate. Many car donation programs aren’t run by the charity itself but by a for-profit company that acts as a middleman.

While that's not automatically a bad thing, these third-party processors take a hefty cut for their services. That slice can significantly shrink the amount of money that actually makes it to the cause you want to help.

Don’t be shy about asking some direct questions:

-

"What percentage of my car's sale price actually goes to the charity's programs?" A reputable organization will be upfront about this. If they give you a vague, roundabout answer, be wary.

-

"Do you handle the process in-house, or do you use a third-party processor?" It’s good to know exactly who is managing the sale of your vehicle.

-

"Can I donate directly to you?" Sometimes, working with a local chapter of a national brand or a smaller community group means your donation has a more direct impact.

Common Scams and Red Flags to Watch For

Unfortunately, there are plenty of operators out there preying on good intentions. Knowing the warning signs can save you a world of headache and protect your donation.

Be on the lookout for these classic red flags:

-

High-Pressure Tactics: If someone is pushing you to make a decision right now, it’s a huge warning sign. A genuine charity will give you the time and space you need.

-

A Vague Mission: Trustworthy nonprofits have a clear purpose. If you can't figure out what they do or who they help after five minutes on their website, that's not a good sign.

-

Guarantees of a Big Deduction: This is a major one. Nobody can promise a specific deduction amount before your car is sold. Your write-off is based on the vehicle's actual sale price (if it’s over $500), and anyone promising otherwise is being dishonest.

Ultimately, putting in the time to research your charity is the best way to feel good about where your car is going. It’s also smart to keep notes of your research—like screenshots of the charity's 501(c)(3) status and any important emails.

Navigating the Necessary Car Donation Paperwork

Once you’ve found the right charity, the next step is the paperwork. This isn’t just about checking off boxes; it's about building an airtight case for your tax deduction. A single missing form or a wrongly signed title can derail the whole process, so this is where paying close attention really matters.

Think of it as telling the story of your donation to the IRS. Every receipt, form, and signature is a crucial part of that narrative. Get it right, and your generous act of donating your car to charity will be properly rewarded come tax time.

The Vehicle Title Is Your Starting Point

The single most important document is your car's title. This is the legal proof of ownership, and without it, you can't officially transfer the vehicle to the charity. It's surprising how often titles go missing, so ensure you locate yours before making the first phone call.

When it's time to sign, follow the charity's instructions precisely. Most will advise you to leave the "buyer" field blank—they’ll complete that when the car is sold. Signing in the wrong spot can void the title and cause significant issues for everyone involved.

Pro Tip: Before you sign anything, take a clear photo of the front and back of the title. This digital copy is invaluable if the original gets lost or you need to verify a detail later.

Having a digital backup of such a key document is wise. Storing these images securely alongside your other donation records keeps everything organized and accessible.

Understanding the Key IRS Forms

After your car is towed away, your focus shifts to the official tax documents the charity will send you. These forms are the backbone of your deduction claim, giving the IRS the proof and valuation it needs. Two forms, in particular, are non-negotiable.

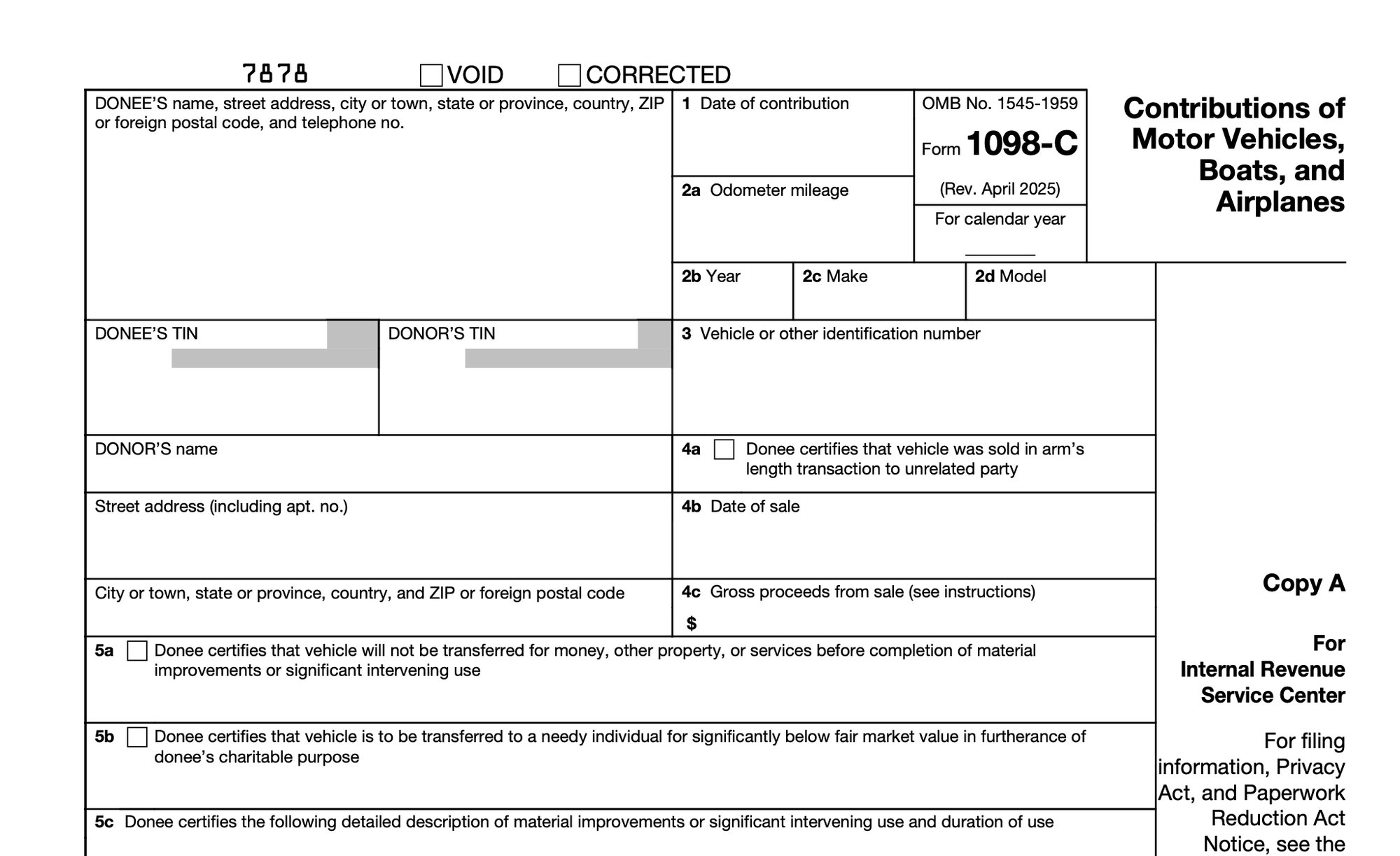

1. Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes

This is the big one. The charity will send this to you after your car is sold, and it's mandatory if the vehicle sells for more than $500. You must have this form before you can claim the deduction on your taxes.

The 1098-C confirms critical details, including:

-

Your name and information as the donor.

-

The vehicle identification number (VIN).

-

The date you made the donation.

-

The gross proceeds from the sale.

That last number—the gross proceeds—is almost always the exact amount you can deduct. Always double-check that the VIN on the form matches the VIN on your old registration. Any mismatch is a potential red flag for the IRS.

Here’s an example of what the IRS page for Form 1098-C looks like.

This official IRS resource is the best place to find the latest version of the form and its instructions, so you know exactly what the charity is required to provide.

2. Form 8283, Noncash Charitable Contributions

You'll need to fill out this form and attach it to your tax return if your total deduction for all noncash gifts (your car included) is over $500. For items valued between $501 and $5,000, you’ll use Section A. If your car donation is valued at more than $5,000, you’ll need to complete Section B, which also requires a formal written appraisal.

Creating an Airtight Digital Paper Trail

Physical papers have a knack for disappearing. That’s why creating a dedicated digital folder for your car donation isn't just a convenience—it's essential for protecting your deduction. The goal is to have a complete, organized record that leaves no room for doubt.

Your digital file should contain:

-

Photos of the signed title (both front and back).

-

A copy of the tow receipt you got at pickup.

-

The final Form 1098-C from the charity, saved as a PDF.

-

A filled-out copy of your Form 8283.

-

Any important emails you exchanged with the charity.

The sheer scale of car donation programs shows why solid record-keeping is so critical. These programs are huge fundraisers for nonprofits—for instance, some have raised over $175 million for organizations like Make-A-Wish. You can find more insights on modern philanthropy in reports on charitable giving in the U.S.. With so many donations happening, making sure your own paperwork is perfect is the only way to guarantee you get the deduction you deserve.

By diligently gathering and organizing these documents, you turn a potentially confusing process into a simple one. This prep work makes tax filing a breeze and gives you peace of mind, knowing your donation is fully and accurately documented.

Nailing the Valuation of Your Donated Car

https://www.youtube.com/embed/o3D2ibIcb3s

Figuring out what your donated car is actually worth for tax purposes can feel like a guessing game. But it's the most critical part of maximizing your deduction. If you get this right, you can confidently claim a significant tax benefit. If you get it wrong, you could lose the deduction entirely or even attract unwanted attention from the IRS.

The whole valuation puzzle really comes down to what the charity ends up doing with your car. More specifically, it hinges on its final sale price. The magic number that changes everything is $500. Once you get your head around this rule, the rest of the process becomes much clearer.

The All-Important $500 Rule

The IRS draws a very clear line in the sand at the $500 mark, and this threshold dictates exactly how you'll calculate your deduction. It's not a guideline—it's a hard rule you must follow when donating your car to charity.

Here’s how it breaks down:

-

If the car sells for $500 or less: You can generally claim the vehicle's Fair Market Value (FMV), but your deduction is capped at $500. So, if your car’s FMV is $800, but the charity only gets $450 at auction, your deduction is limited to $500.

-

If the car sells for more than $500: Your deduction is limited to the exact gross proceeds from the sale. No wiggle room here. If your car sells for $2,100, your deduction is precisely $2,100.

This is exactly why you must wait for the charity to sell the vehicle and send you Form 1098-C before you can finalize your tax return. That form is your golden ticket—it lists the official sale price, which becomes the number you use for your deduction.

How to Figure Out Fair Market Value

For those times when you can claim Fair Market Value (i.e., when the car sells for $500 or less), you need a solid, defensible way to determine that value. You can't just pull a number out of thin air. The IRS defines FMV as the price a willing buyer would pay a willing seller when both parties know all the relevant facts and neither is under pressure to act.

To establish a credible FMV, you need to turn to recognized resources.

Reputable Guides for Vehicle Valuation:

-

Kelley Blue Book (KBB): This is the go-to for most people. Use the "Private Party Value" and be brutally honest about your car's condition (Fair, Good, etc.) to get an accurate estimate.

-

Edmunds: Another excellent source that gives you a True Market Value (TMV) based on what similar cars have recently sold for in your area.

-

NADAguides: Often used by dealers and banks, this guide is another great data point for establishing a credible value.

Here's a real-world example: You donate a 15-year-old sedan that runs but has some visible rust. KBB puts its private party value in "Fair" condition at $950. A few weeks later, the charity sells it at auction for $400. Since the sale price was under the threshold, you can claim its FMV, but your deduction is capped at $500.

Pro tip: Always take screenshots of the valuation reports and save them with your tax records.

The Big Exceptions to the Sale Price Rule

While the sale price is usually the final word, there are a few important exceptions where you can claim the car's full Fair Market Value, even if it's way over $500. These are game-changers for maximizing your deduction.

These special cases kick in when the charity:

-

Makes "significant intervening use" of the car: This means they actually use the vehicle in their day-to-day work, like using a donated van to deliver meals to seniors for a year.

-

Makes "material improvements" to the car: The charity puts in significant work to repair or upgrade the vehicle before selling it.

-

Gives or sells the car to a needy person at a deep discount: This has to be part of the charity's core mission to help the disadvantaged.

If your donation falls into one of these buckets, the charity will check a specific box on your Form 1098-C and certify it. That’s your green light to claim the full FMV, which you’ll then need to back up with a valuation guide. This can make a massive difference. A car that sells for $1,200 might have an FMV of $3,500, and this exception lets you claim that much larger amount.

Claiming and Maximizing Your Tax Deduction

This is where all your hard work pays off. You've chosen a reputable charity, navigated the paperwork, and are ready to claim the tax deduction you've rightfully earned. Getting from "car gone" to "taxes filed" is straightforward once you know the steps and have your documents in order.

The final stretch begins when the tow truck arrives. Before they drive off, make sure you get a copy of the tow receipt. That little piece of paper is your first official record. It's more than a formality—it's proof of the exact date you made the donation, which is critical for your tax return.

The Power of Meticulous Record-Keeping

When tax season arrives, relying on memory won't suffice with the IRS. They require evidence. Being organized becomes your greatest asset, transforming the process of donating your car to charity from a hectic search for documents into a calm, stress-free task.

Your goal is to create a comprehensive account of your donation. This involves capturing images of the car's condition just before pickup, photographing the signed title, and retaining copies of all documents. These elements form an irrefutable record of your contribution.

Key Insight: While the IRS doesn't expect you to be a tax expert, they do expect you to be organized. A complete, straightforward paper trail is your best support if any questions arise about your deduction.

Keeping an organized collection of photos and documents ensures nothing is misplaced and everything is prepared for tax time.

From Form 1098-C to Your Tax Return

Once the charity sells your vehicle, they’ll mail you Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes. This is the single most important document in the whole process. If the car sold for more than $500, you absolutely must have this form before you file your taxes.

This form officially states the gross proceeds from the sale—and that's the exact amount you're allowed to deduct.

Here’s how you get that number onto your tax return:

-

Grab Schedule A (Itemized Deductions): This is where you list all your itemized deductions, including charitable contributions.

-

Enter the Donation Amount: On the "Gifts to Charity" line, write in the sale amount shown on your Form 1098-C.

-

Attach Your Proof: You must attach a copy of Form 1098-C to your tax return. And if your total noncash donations for the year top $500, you'll also need to fill out and attach Form 8283, Noncash Charitable Contributions.

Think of it this way: Form 1098-C is the charity's official verification, and Form 8283 is your formal declaration to the IRS. You need both to complete the picture.

Building Your Evidence File for Maximum Confidence

To file your return without any last-minute panic, you need a complete evidence file. Just imagine an IRS agent asking you to prove everything—your file should have all the answers.

Your Essential Checklist:

-

Photographic Proof: Clear photos of the car from every angle, the odometer reading, and close-ups of any major dents or scratches. This backs up the vehicle's condition.

-

The Pickup Receipt: That initial receipt from the tow company confirming the donation date.

-

Title Transfer Records: A photo or scan of the signed-over vehicle title.

-

Official Charity Communications: Save any important emails or letters you received.

-

IRS Forms: Keep a digital copy of the finished Form 1098-C from the charity, plus your own completed Form 8283.

You can definitely gather all this manually, but using an app makes it a whole lot easier. You just upload each document as it comes in. When you're ready to file, you can generate a single, professional report with every piece of evidence. This simple step turns a messy task into an organized process, ensuring you can confidently claim every single dollar you deserve.

Got a Few Lingering Questions?

Even after you've picked the perfect charity and started gathering paperwork, a few "what ifs" can still pop up. That’s completely normal. Let’s walk through some of the most common questions donors have so you can move forward with total confidence.

I hear this one all the time: people hesitate because they think their car isn't "good enough" to be a worthy donation. Let's clear that up right now.

Can I Donate a Car That Doesn’t Run?

Absolutely. In fact, most charities are happy to take vehicles in any condition, whether they're pristine, have a few dings, or haven't started in years.

They have established relationships with auction houses and salvage yards that are masters at getting value out of non-running cars. They'll either sell it for parts or scrap metal, and every dollar goes toward the charity's mission. The best part? They almost always handle the towing for free, so you don't have to stress about getting it off your property. Your final tax receipt will simply reflect what the car sold for, and that's the amount you get to deduct.

What if I Can't Find My Car Title?

This is a common hiccup, but it’s an essential one. You need the title to legally transfer ownership to the charity. If you’ve misplaced it, your first stop should be your state's Department of Motor Vehicles (DMV) to request a duplicate.

My advice? Get this sorted out before you even contact a charity. It can sometimes take a few weeks to get the new title in the mail, and attempting to start the donation process without it will just lead to headaches and delays for everyone.

A Quick Pro Tip: While you're on the DMV website or at the office, look up the specific rules for transferring a title for a donation in your state. A few minutes of prep work here will save you a lot of time down the road.

Keeping a digital trail of everything is a smart move. Consider tracking the duplicate title application, photos of your car, and eventually, the tax forms from the charity. Organizing these documents securely ensures everything is ready when you sit down to do your taxes.

How Long Does This Whole Process Take, Anyway?

The first part is surprisingly quick. You can usually fill out the charity's online form or make a phone call in just a few minutes. From there, they typically schedule the pickup within one to three business days.

The waiting game comes next. It can take anywhere from a couple of weeks to over a month for the car to actually sell at auction, depending on their schedule and what the market looks like. Once the sale is a done deal, the charity has 30 days to send you Form 1098-C, your official tax receipt. Remember, you have to have that form in your hands before you can claim the deduction on your tax return.