-

1/1/2026

1/1/2026Introducing the DeductAble Web App

Great news for DeductAble users: You can now track your charitable donations directly from your web browser. Whether youre at your desk, on a Chromebook, or simply prefer a larger screen — DeductAbles full-featured web app is live and ready for you at app.deductable.ai. Why a Web App? Since launching DeductAble on iOS, one of

-

12/14/2025

12/14/2025Navigating the Noncash Charitable Contributions Limit

Donating things you no longer need is a great way to support the causes you believe in and maximize your itemized tax deductions. But to get the most out of your generosity at tax time, you need to understand the noncash charitable contributions limit. This isnt some arbitrary dollar amount. The IRS caps your deduction

-

11/24/2025

11/24/202510 Common Tax Deductions Missed in 2025 That Cost You Money

Tax season often feels like a race against the clock, with many of us opting for the simplest path forward to meet the deadline. In that rush, its incredibly easy to overlook valuable write-offs that could significantly lower your tax bill. Every year, hardworking taxpayers overpay by hundreds, even thousands, of dollars simply because they

12/5/2025

Are Funeral Expenses Tax Deductible?

Let’s get straight to the point: funeral expenses are almost never tax-deductible on your personal tax return. The IRS sees these costs as a personal expense, plain and simple. That means you can’t claim them on your Form 1040, no matter how significant the financial strain.

Are Funeral Expenses Tax Deductible

While you can’t write off funeral costs on your own taxes, there’s one major exception: for the estate of the person who passed away.

Think of it this way: the deduction doesn’t belong to a family member paying the bills. It belongs to the deceased’s estate itself, but only if the estate is large enough to owe federal estate taxes in the first place.

Funerals in the U.S. represent a major financial event for most families. In 2023, the median cost for a funeral with a viewing and burial hit $8,300. Even a cremation service averaged $6,280. Despite these steep costs, the IRS is firm. But for the small percentage of estates valued above the federal exemption—a whopping $13.61 million for 2024—funeral costs can be deducted on the estate’s tax return, IRS Form 706.

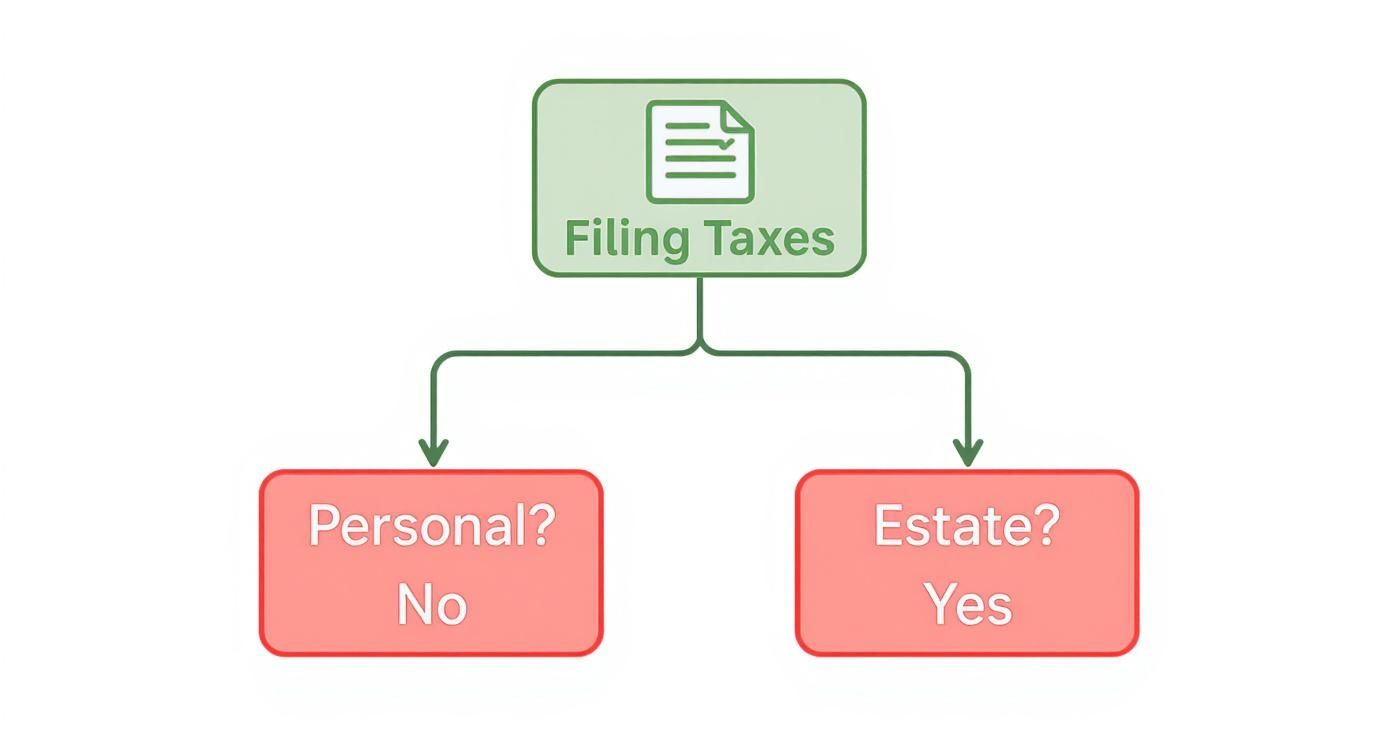

This simple chart breaks down where the deduction might apply.

As you can see, the path to a deduction only opens up when you’re dealing with an estate tax return, not a personal one.

Understanding the Difference

The real distinction comes down to who is filing the taxes. You, as an individual, file a personal income tax return (Form 1040) where everyday living costs don’t count as deductions. An estate, on the other hand, is a separate legal and financial entity that files its own return (Form 706) to wrap up the deceased’s final affairs.

Here’s a clear comparison to help you see the difference.

Deducting Funeral Costs Personal vs Estate Tax

| Aspect | Individual Income Tax (Form 1040) | Federal Estate Tax (Form 706) |

|---|---|---|

| Deductibility | No, considered a non-deductible personal expense. | Yes, treated as a liability that reduces the estate’s value. |

| Who Claims It? | No one. | The executor of the estate. |

| When It Applies | Never. | Only if the estate’s value exceeds the $13.61 million federal exemption. |

| Purpose | Reduces an individual’s taxable income. | Reduces the estate’s total taxable value before tax is calculated. |

In short, your personal tax return is for your own income and expenses, while the estate tax return handles the final accounting for the deceased’s assets and liabilities—including their funeral costs.

Getting a handle on tax deductions is key, especially when you’re figuring out your filing strategy. For a deeper dive, check out our guide on the itemized deduction vs standard deduction.

How the Estate Tax Deduction Actually Works

While you can’t deduct funeral costs on your personal income tax return, there’s one major exception: the federal estate tax. This is where the deduction for funeral expenses finally gets its moment, but it’s a stage reserved for a very small fraction of the population.

Think of an estate as a temporary financial entity that pops into existence when someone passes away. This entity holds all the assets, like property and investments, but it’s also responsible for all the liabilities, like debts and final expenses. Before any inheritance can be passed on to the heirs, the estate has to settle all its bills—and funeral costs are one of those bills.

The federal estate tax is essentially a tax on the transfer of significant wealth from the deceased to their beneficiaries. The government, however, sets an incredibly high bar for this tax. For 2024, an estate has to be worth more than $13.61 million before it owes a single dollar in federal estate tax.

Let that sink in. The vast majority of estates will never come close to this threshold, which means they’ll never file an estate tax return and, therefore, won’t be able to use this deduction.

Reducing the Taxable Estate Value

For those rare estates that do exceed the exemption amount, the process is pretty straightforward. The executor of the estate files IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return. On this form, specifically on Schedule J, the executor can list all reasonable funeral costs.

These costs are then subtracted directly from the total value of the estate.

Key Takeaway: The deduction for funeral expenses isn’t like a personal tax write-off. Instead, it shrinks the overall size of a multi-million-dollar estate, which in turn lowers the final estate tax bill. It’s a tool for settling the estate’s final accounts, not a tax break for the average family.

For example, if an estate is valued at $14 million, deducting $15,000 in funeral expenses would knock its taxable value down to $13,985,000. This is a crucial distinction: the deduction benefits the estate, not the individuals who might have fronted the money for the services.

The Role of Donations and Record Keeping

While navigating an estate, many families also find themselves managing charitable contributions made in memory of their loved one. These donations, unlike the funeral costs themselves, are deductible for the person who actually makes them. The problem is, keeping track of these gifts can get messy during an already stressful time.

What Funeral Costs Qualify for the Estate Tax Deduction?

When an estate is large enough to be taxed, the IRS allows deductions for funeral expenses, but with a catch: the costs must be “reasonable.” This isn’t a blank check for a lavish send-off. Instead, it’s a guideline to make sure the expenses line up with the deceased’s lifestyle and financial standing.

For an executor, knowing which costs make the cut is crucial for accurately filling out Schedule J on Form 706 and trimming the estate’s final tax bill.

The funeral industry in the U.S. is a massive economic engine, with funeral homes alone generating around $16.3 billion a year. And that’s before you even count related services like cemeteries and florists. You can dig into more of these stats over at the NFDA website.

Despite this, direct tax relief for the average family paying for a funeral is almost nonexistent. But for a qualifying estate, these deductions can make a real difference. A $12,500 funeral expense deduction, for example, could slice about $5,000 off the estate’s tax bill at a 40% tax rate.

Core Deductible Funeral Home and Service Fees

The easiest deductions to claim are the ones directly tied to the funeral service itself. These are the foundational costs the IRS usually accepts without a fuss, as long as you have the receipts to back them up.

- Funeral Director Services: This bucket covers the professional fees for planning the service, embalming and preparing the body, and the general overhead of the funeral home.

- Casket or Urn: The cost of the container for burial or cremation is a primary, deductible expense.

- Viewing or Visitation: Any costs tied to preparing and hosting a viewing or wake are eligible.

- Funeral Ceremony: This includes fees for the service, whether it’s held at a funeral home, a house of worship, or another location.

These expenses typically make up the bulk of what an estate can claim when figuring out its final tax liability.

Burial and Transportation Costs

Beyond the service, the costs of getting the deceased to their final resting place are also deductible. These often add up to a significant chunk of the total bill.

Important Note: There’s one critical rule here—the expense must be paid from the estate’s funds. If a family member pays out-of-pocket and isn’t reimbursed by the estate, the estate can’t claim that cost as a deduction.

Here’s what typically qualifies in this category:

- Burial Plot or Cemetery Niche: The purchase price of the final resting place.

- Headstone or Grave Marker: The cost to create and install a monument.

- Cremation Fees: The direct cost charged for the cremation process itself.

- Transportation of the Deceased: This covers moving the body to the funeral home and the use of a hearse for the service.

Other Allowable Expenses to Consider

Some of the less obvious costs can qualify, too. The IRS often allows deductions for things like flowers, catering for a reception after the service, and even travel costs for the immediate family to get to the funeral. The key is to keep meticulous records of every single one of these expenditures.

Exploring Rare and Niche Scenarios

While the estate tax deduction is the most common path, the conversation around whether funeral expenses are tax deductible doesn’t completely stop there. A few very specific—and admittedly rare—situations pop up where funeral costs can lead to some form of financial relief, even if it’s not a direct tax deduction in the way we usually think of it.

These edge cases aren’t everyday occurrences, but they’re important to know about.

One of the most tragic examples is a wrongful death lawsuit. If a court awards a settlement to the surviving family, the amount they paid for the funeral can often be used to offset the total settlement value. This doesn’t make the funeral costs deductible on a 1040 tax form, but it does mean the family is made whole for those expenses as part of the final, non-taxable award.

Another niche area involves business-related deaths. Imagine an employee passes away while on the job or traveling for work. If the company steps up to pay for the funeral, they can often claim those costs as a necessary and ordinary business expense. Here, the deduction benefits the business, not the family, but it’s a scenario where the financial weight is lifted from the loved ones.

Government Interventions and Unique Circumstances

Perhaps the most powerful example of a unique situation was the temporary federal program for COVID-19-related deaths. This wasn’t a tax deduction at all, but a direct reimbursement program that shows how the government can step in during a national crisis.

During the COVID-19 pandemic, the U.S. government, through a special congressional bill, provided direct financial relief for funeral costs. Administered by the Federal Emergency Management Agency (FEMA), this taxpayer-funded program was massive, distributing an incredible $2.8 billion across 438,000 approved applications. This resulted in an average award of $6,400 per family. You can discover more insights about how this program and the pandemic impacted the funeral industry.

This temporary FEMA program really drives a key point home: while standard tax law almost never allows for a personal funeral deduction, extraordinary circumstances can lead to unique, government-led financial relief programs completely outside the tax system.

Although these scenarios are far from typical, they show that financial help for funeral costs can sometimes be found in unexpected places. Each case, however, is highly dependent on its specific legal or situational context.

Making Charitable Donations in a Loved One’s Memory

While the direct path to deducting funeral expenses on your personal income tax is incredibly narrow, there’s a much more common and heartfelt strategy that’s available to almost everyone: making a memorial donation. You’ve likely seen it before—families requesting donations to a cause the deceased cared about, often “in lieu of flowers.”

This simple act of generosity does two powerful things at once. It’s a beautiful way to honor your loved one’s memory by supporting an organization that was meaningful to them, and it can also provide you, the donor, with a valuable tax deduction.

Unlike funeral costs, which the IRS views as a personal expense, charitable contributions are fully deductible on your tax return if you itemize. This allows you to turn a meaningful tribute into a tangible financial benefit at tax time by lowering your overall taxable income.

Making Sure Your Memorial Donation Counts

To ensure your heartfelt gift actually translates into a tax deduction, you need to follow a few key steps. It all comes down to verifying the organization’s status and keeping meticulous records.

First, you absolutely must confirm the charity is a qualified 501(c)(3) organization. The easiest way to do this is with a quick check on the IRS’s own Tax Exempt Organization Search tool. It’s a crucial step because donations to individuals, political campaigns, or non-qualified groups—no matter how well-intentioned—are not tax-deductible.

Next, documentation is everything. For any donation you make, you need a record. This could be a bank statement, a canceled check, or a receipt from the charity itself. But for any single contribution of $250 or more, the rules get stricter: a written acknowledgment from the organization is non-negotiable. For a complete rundown of what the IRS is looking for, check out our guide to charitable donation receipt requirements.

How Funeral Tax Rules Compare Globally

If you’re wondering whether other countries handle funeral expenses differently, the answer might surprise you. When you look at tax laws around the world, the U.S. approach—limiting these deductions almost exclusively to large estates—is actually the global norm.

Most countries treat funeral costs as a private family matter, not a public expense that qualifies for broad income tax relief. It’s a common-sense approach that you’ll find in many developed nations.

A Look at International Tax Policies

Take countries like the United Kingdom and Canada, for example. They follow a very similar principle to the U.S., treating funeral costs as a final debt that needs to be settled by the deceased’s estate before any inheritance gets distributed. Just like here, the deduction is a benefit for the estate, not a personal tax break for the family members who paid the bills.

This near-universal agreement puts the U.S. policy into a much clearer context. Very few tax systems worldwide allow individuals to write off funeral costs on their personal income taxes. One rare exception is Argentina, which does permit a small deduction, but only up to a specific annual limit set by its tax authorities. You can dive deeper into how funeral expenses are treated globally if you’re curious about the specifics.

Global Perspective: At the end of the day, most developed nations agree: funeral costs are a final liability of the deceased’s estate. The idea of getting a personal income tax deduction for them is an outlier in international tax policy, which helps explain the IRS’s long-standing position.

Ultimately, this global comparison shines a light on a core principle in tax law. The financial responsibility for a funeral is almost always placed on the estate or the family, and direct tax relief for the individuals footing the bill is exceptionally rare.

Your Funeral Tax Questions, Answered

Even with the main rules laid out, dealing with the financial side of a loved one’s passing brings up a lot of specific questions. Let’s walk through some of the most common ones that come up when people are trying to figure out if funeral expenses are tax deductible.

Can I Deduct My Travel Costs to Attend a Funeral?

This is one of the first questions people ask, and unfortunately, the answer is no. The IRS sees travel for a family funeral—things like your flight, hotel, and meals—as a personal expense. As a result, you can’t deduct it on your personal tax return.

The only time travel costs might come into play is for the estate itself, which can sometimes deduct the reasonable travel expenses for an immediate family member to get to the service.

Are Cremation and Burial Costs Treated Differently by the IRS?

Nope, for tax purposes, there’s no difference at all. The IRS treats both cremation and burial expenses exactly the same.

For an individual, they’re personal costs. For an estate, they’re deductible on the estate tax return (Form 706), but only if the estate is large enough to exceed the federal exemption threshold.

It’s interesting to see how preferences have changed over time. Cremation is becoming far more common, with projections showing rates in the U.S. could hit 78.7% by 2040—a huge shift from traditional practices. You can discover more insights about these funeral trends here.

What if I Paid for the Funeral Myself Out of Pocket?

This is a critical point that trips up a lot of people. If you personally paid for the funeral and the estate didn’t reimburse you, you cannot claim a tax deduction for those costs.

Only the estate has the ability to deduct funeral expenses, and only if it pays for them directly from its own funds.

It’s so easy to get confused about what you can and can’t write off, and that confusion often leads to missed savings. To make sure you’re not leaving money on the table, check out our guide on common tax deductions people often miss.

While you can’t deduct most funeral costs on your personal return, you can always deduct charitable donations made in a loved one’s memory.

DeductAble gives you a simple, modern way to track every single one of those donations, ensuring you get the maximum tax benefit for your generosity. It’s the perfect ItsDeductible replacement, helping you create a clean, accurate report for tax time without the headache. Learn more and start tracking today.