-

1/1/2026

1/1/2026Introducing the DeductAble Web App

Great news for DeductAble users: You can now track your charitable donations directly from your web browser. Whether youre at your desk, on a Chromebook, or simply prefer a larger screen — DeductAbles full-featured web app is live and ready for you at app.deductable.ai. Why a Web App? Since launching DeductAble on iOS, one of

-

12/14/2025

12/14/2025Navigating the Noncash Charitable Contributions Limit

Donating things you no longer need is a great way to support the causes you believe in and maximize your itemized tax deductions. But to get the most out of your generosity at tax time, you need to understand the noncash charitable contributions limit. This isnt some arbitrary dollar amount. The IRS caps your deduction

-

12/5/2025

12/5/2025Are Funeral Expenses Tax Deductible?

Lets get straight to the point: funeral expenses are almost never tax-deductible on your personal tax return. The IRS sees these costs as a personal expense, plain and simple. That means you cant claim them on your Form 1040, no matter how significant the financial strain. Are Funeral Expenses Tax Deductible While you can’t write

11/7/2025

Itemized Deduction vs Standard Deduction: Which Saves You More on Taxes?

When it’s time to file your taxes, one of the biggest decisions you’ll make boils down to a simple question: which deduction method will save you the most money? On one hand, you have the standard deduction—a fixed, no-questions-asked dollar amount set by the government that instantly reduces your taxable income. On the other, you have itemized deductions, where you can tally up specific, eligible expenses to subtract instead.

The logic is straightforward: if your total itemized deductions add up to more than the standard deduction for your filing status, you should itemize. For many, the key to unlocking those savings lies in an often-overlooked area: charitable donations.

Understanding Your Deduction Options

Think of it as choosing between two paths. One is simple and direct, while the other requires a bit more effort but can lead to a much bigger tax break. The goal for either path is the same: to legally lower your adjusted gross income (AGI) as much as possible, which in turn shrinks your final tax bill.

Standard Deduction vs. Itemized Deduction at a Glance

To make sense of the core differences quickly, here’s a simple breakdown of how the two methods stack up against each other.

| Feature | Standard Deduction | Itemized Deductions |

|---|---|---|

| Simplicity | High. It’s a fixed amount based on your filing status. No math required. | Lower. You need to track specific expenses and have the docs to prove it. |

| Record-Keeping | Minimal to none. | Extensive. Get ready to save receipts, statements, and detailed records. |

| Potential Savings | Fixed and predictable. You know exactly what you’re getting. | Can be much higher if your eligible expenses exceed the standard amount. |

| Who Benefits | Taxpayers with simpler finances, renters, or those with few deductible costs. | Homeowners, high-earners in high-tax states, and those who give generously to charity. |

This table gives you a great starting point, but the real story is in how tax law has changed the game for millions of Americans.

The Impact of Tax Law Changes

The Tax Cuts and Jobs Act (TCJA) of 2017 completely reshaped this decision. By nearly doubling the standard deduction amounts, the law made it the better financial choice for a huge portion of the population. The change was so significant that the percentage of taxpayers who itemize plummeted from around 30% before the TCJA to less than 10% today. You can read more about how the TCJA impacted tax deductions on the Tax Policy Center’s website.

For many, this shift means taking the standard deduction is a no-brainer—it offers a bigger tax break without the headache of tracking every last expense.

But for those with significant costs like mortgage interest, high state and local taxes, or substantial charitable donations, itemizing is still a powerful financial strategy. This is where maximizing every possible deduction—especially from charitable giving—becomes critical. DeductAble is invaluable here, helping you accurately value and document every non-cash donation to ensure you clear the high bar set by the standard deduction and get the tax break you deserve for your generosity.

Understanding the Standard Deduction

Think of the standard deduction as the tax system’s simplest off-ramp. It’s a fixed dollar amount, set by the IRS and based on your filing status, that you can subtract right off your income. No receipts, no math, no fuss.

This straightforward approach is designed to make tax filing easier for millions of Americans, offering a clear path to tax savings without the headache of tracking every last deductible expense.

Instead of meticulously adding up mortgage interest, state taxes, and charitable gifts, you just claim the single amount designated for your situation. The IRS even adjusts these amounts for inflation each year, so they stay relevant.

Who Benefits Most from the Standard Deduction

This method is a perfect fit for people with straightforward financial lives. If you don’t have a mountain of deductible expenses, taking the standard deduction isn’t just easier—it’s usually the smarter financial move.

You’ll probably find the standard deduction is your best bet if you are:

- A renter without any mortgage interest to write off.

- Someone with few major expenses, like high medical bills or large charitable donations.

- A taxpayer who values simplicity and less paperwork more than chasing every last dollar.

- Living in a state with low or no state income tax, which means your State and Local Tax (SALT) deduction wouldn’t be very high anyway.

In short, if you add up all your potential itemized expenses and the total doesn’t even come close to the standard deduction, this is your path. It’s clean, simple, and efficient.

Standard Deduction Amounts for 2024

The IRS lays out specific standard deduction amounts based on how you file. For the 2024 tax year (the return you’ll file in 2025), here are the numbers to know:

- Single: $14,600

- Married Filing Jointly: $29,200

- Married Filing Separately: $14,600

- Head of Household: $21,900

It’s also worth noting there’s an extra boost for taxpayers who are age 65 or older, or who are blind. This additional amount—$1,550 for married folks or $1,950 for singles in 2024—gets tacked right onto your standard deduction, further lowering what you owe.

While this option is almost universal, there are a few specific situations where you can’t take it. For example, if you’re married but file separately and your spouse decides to itemize their deductions, you’re not allowed to take the standard deduction. It’s always smart to double-check your eligibility before you lock in your choice.

A Look at Common Itemized Deductions

So, you’ve crunched the numbers and realized your potential deductions might just beat the standard amount. What now? It’s time to start itemizing. This is where you get to subtract specific, eligible expenses from your income, which often leads to some serious tax savings.

Let’s break down the most common write-offs that help people cross that threshold.

The choice between the standard deduction and itemizing is a big deal for your bottom line. Since the TCJA nearly doubled the standard deduction, only about 10% of taxpayers now itemize. That’s why understanding every potential deduction—especially those from your charitable giving—is so critical to making the right choice. The IRS offers some great insights on the difference between the two.

Mortgage Interest and State Taxes

For homeowners, the mortgage interest deduction is often the MVP of their tax return. It’s usually the single biggest reason people choose to itemize. You can typically deduct the interest you paid on up to $750,000 of mortgage debt used to buy, build, or significantly improve your primary home (or even a second one). This deduction alone can get you pretty close to the standard deduction amount.

Another major player is the State and Local Tax (SALT) deduction. This lets you write off your property taxes plus either your state income taxes or your state sales taxes. But—and this is a big but—the SALT deduction is currently capped at $10,000 per household, per year.

Significant Medical Expenses

The medical expense deduction has a pretty high bar to clear, but if you have a year with major health costs, it can provide huge relief. Here’s the catch: you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI). This includes things like doctor visits, hospital bills, prescriptions, and even the miles you drive for medical appointments.

Charitable Contributions: The Deduction That Tips the Scales

This is the one people so often underestimate. For many taxpayers, charitable giving is the key that unlocks the benefits of itemizing. This deduction goes way beyond the cash you hand over; it also includes the fair market value of all the goods you donate—the clothing, furniture, and household items you drop off at qualified charities.

A lot of taxpayers leave money on the table by either guessing at the value of their non-cash donations or forgetting to track them altogether. Every bag of clothes or box of old electronics has a value that pushes you closer to beating the standard deduction.

This is where being meticulous about your generosity really pays off. All those small non-cash donations can add up faster than you think. And if you donate a big-ticket item? That can be a game-changer. For a deeper dive, check out our guide on donating your car to charity.

The real challenge is figuring out an accurate, defensible value for every single item you give away. Guesswork isn’t just a bad habit; it can lead to inaccurate filings and missed savings. This is exactly why tools built for donation tracking, like DeductAble, are so essential.

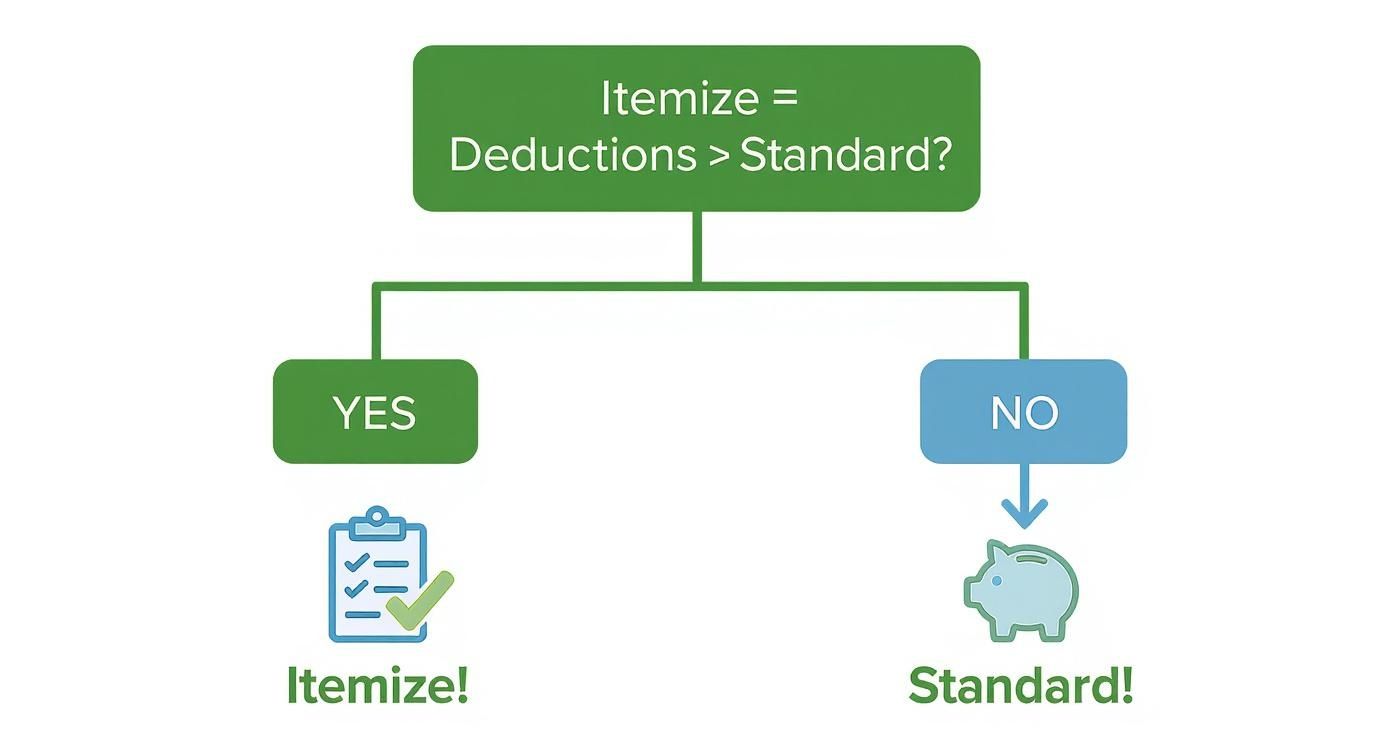

How to Choose the Right Deduction Method

Deciding between the standard and itemized deduction really comes down to one simple question: do your individual deductible expenses add up to more than the standard deduction for your filing status? If they do, you itemize. If not, you stick with the standard. It’s that straightforward.

Think of it as a financial scavenger hunt. The first step is to round up all your potential write-offs and see what they’re worth. You might be surprised by how quickly they add up.

Calculating Your Potential Itemized Deductions

Before you can make the call, you need a solid estimate of what you can actually claim. Here’s a quick rundown of the big-ticket items to look for:

- Mortgage Interest: This is often the biggest deduction for homeowners. Find the total on the Form 1098 your lender sends you.

- State and Local Taxes (SALT): This includes your property taxes plus either your state income taxes or your state sales taxes. Just remember, this one is capped at $10,000 per household.

- Charitable Donations: Add up any cash you gave, but don’t forget the fair market value of all the stuff you donated. Clothes, old furniture, electronics—it all counts, and this is where people often leave a lot of money on the table.

- Medical Expenses: You can only deduct out-of-pocket medical costs that exceed 7.5% of your Adjusted Gross Income (AGI). It’s a high bar, but for some, it makes a huge difference.

Once you’ve got these numbers, add them all up. That final figure is what you’ll compare against the standard deduction to see which option puts more money back in your pocket.

This decision tree gives you a clean visual for figuring out which path to take.

It boils the choice down to a single calculation: if your tracked expenses are higher than the government’s fixed amount, it’s time to itemize.

The best choice really depends on your specific financial situation. Here’s a quick guide to see which profile you might fit into.

Who Typically Benefits From Each Deduction Method

| Taxpayer Profile | Likely Best Choice | Primary Reason |

|---|---|---|

| New Homeowners | Itemized | High mortgage interest and property taxes often exceed the standard deduction. |

| Renters in Low-Tax States | Standard | Without mortgage interest or significant state taxes, it’s tough to beat the standard. |

| High Earners in High-Tax States | Itemized | Even with the $10,000 SALT cap, mortgage interest and large charitable gifts can push them over. |

| Generous Givers | Itemized | Significant cash and non-cash charitable donations can easily surpass the threshold. |

| Retirees with Paid-Off Homes | Standard | No mortgage interest means their largest potential deduction is gone. |

| Those with High Medical Bills | Itemized | If out-of-pocket costs exceed the 7.5% AGI floor, this can be a massive deduction. |

Ultimately, you have to run the numbers for yourself. What works for one person might not work for another, even if their lives look similar on the surface.

Real-World Scenarios

Let’s see how this plays out for a couple of different taxpayers.

Scenario 1: The New Homeowner

- Profile: A married couple, filing jointly. They just bought a house and paid $20,000 in mortgage interest. They also hit the $10,000 SALT cap with their property and state income taxes. On top of that, they donated $2,000 worth of cash and goods.

- Calculation: $20,000 (mortgage) + $10,000 (SALT) + $2,000 (charity) = $32,000 in itemized deductions.

- Decision: Their $32,000 total easily beats the $29,200 standard deduction for married couples. They should absolutely itemize.

Scenario 2: The Generous Retiree

- Profile: A single filer who is retired. Her house is paid off, but she had $9,000 in medical bills on an AGI of $60,000. Her SALT adds up to $4,000, and she’s a very active donor, giving $5,000 in non-cash items to her favorite charity.

- Calculation: First, her medical deduction is only the amount over 7.5% of her AGI, so $9,000 – ($60,000 * 0.075) = $9,000 – $4,500 = $4,500. Add it all up: $4,500 (medical) + $4,000 (SALT) + $5,000 (charity) = $13,500.

- Decision: Her $13,500 total is less than the $14,600 standard deduction for a single filer. She’s better off taking the standard deduction.

These examples show just how personal the decision is. For those who give a lot to charity, getting the value of non-cash donations right is critical. Using an app like DeductAble ensures every donated item is valued correctly according to IRS guidelines, helping you capture every last dollar and possibly tipping the scales in favor of itemizing.

Maximizing Donations to Tip the Scales for Itemizing

When you’re hovering right on the edge of that itemization threshold, every single dollar counts. For a lot of taxpayers, the secret to finally pushing past the standard deduction isn’t buried in mortgage interest or state taxes. It’s often hiding in their charitable giving—specifically, the non-cash donations that so many of us forget to track.

Think about it. Every bag of clothes, every box of old toys, or that piece of furniture you dropped off at Goodwill has a fair market value. On their own, these values might not seem like much, but they add up surprisingly fast. Failing to accurately track and value these items is a huge missed opportunity to lower your tax bill.

Capturing the True Value of Your Generosity

The biggest headache with non-cash donations is figuring out what they’re actually worth in a way the IRS will accept. Guessing is a terrible strategy. It can lead you to under-claim your deduction or, even worse, raise red flags with the IRS. This uncertainty is why so many people just undervalue their stuff or don’t bother claiming it at all.

This is exactly where a little bit of tech can make a massive difference. Instead of pulling numbers out of thin air, you can use a tool built for this exact job.

By using DeductAble’s extensive database of fair market values, you can instantly see what your donations are worth. It gives you the confidence that you’re claiming the maximum legal amount without the guesswork.

Documentation Rules for Charitable Gifts

Whether you give cash or goods, the IRS wants to see proof. The kind of documentation you need really depends on the type and value of your donation.

- For any cash donation: You’ll need a bank record (like a canceled check or credit card statement) or a written receipt from the charity.

- For non-cash donations under $250: A receipt from the charity showing its name, the date, and a description of the items is a must.

- For non-cash donations between $250 and $500: You need a “contemporaneous written acknowledgment” from the organization that gets into the details of what you gave.

- For non-cash donations over $500: On top of the receipt, you have to fill out and file Form 8283, Noncash Charitable Contributions, with your tax return.

The record-keeping can feel like a pain, but it’s absolutely non-negotiable if you want to claim the deduction. This is another spot where using a dedicated donation tracker pays for itself by keeping all your receipts and valuations organized in one place.

Ultimately, maximizing this deduction just comes down to being diligent. By carefully tracking both your cash and non-cash gifts, you turn your generosity into a powerful tool that can make the itemized deduction vs standard deduction decision a whole lot clearer. To get into the nitty-gritty, you can learn more about what donations are tax deductible and make sure you’re not leaving money on the table.

When your giving is properly documented, it can easily provide that final push you need to get over the standard deduction hump and unlock some serious tax savings.

Frequently Asked Questions About Tax Deductions

Figuring out whether to itemize or take the standard deduction can bring up a lot of questions. Here are some quick, clear answers to the most common ones we hear, designed to help you file with a lot more confidence.

Can I Switch Between Standard and Itemized Deductions Each Year?

Yes, you absolutely can—and you should. The best choice is tied directly to your financial picture for that specific year, which can change in a big way from one tax season to the next. You’re never locked into the method you used on a previous return.

For example, you might take the standard deduction one year as a renter. But if you buy a home the following year, you suddenly have mortgage interest and property taxes to account for. In that scenario, itemizing could easily become the smarter move. It’s always worth re-evaluating where you stand each year.

What Records Do I Need to Keep if I Itemize?

If you decide to itemize, think of meticulous record-keeping as non-negotiable. The IRS requires you to be able to back up every single deduction you claim in the event of an audit.

Here are the essential documents to hang onto:

- Mortgage Interest Statements (Form 1098) from your lender.

- Property tax records from your local government.

- Receipts and bank statements for any cash-based charitable contributions.

- Detailed records for non-cash donations, which must include a list of items, their condition, their fair market value, and an official receipt from the charity.

Getting the documentation right for non-cash gifts is critical. You can learn more about the specifics in our guide on understanding Goodwill donation receipts.

Does My State Have Its Own Standard Deduction?

Most states with an income tax do have their own standard deduction, but the rules and amounts often look different from the federal guidelines. It’s pretty common for a state’s standard deduction to be a lot lower than the federal amount.

This can create a situation where you take the standard deduction on your federal return but find it’s better to itemize on your state tax return. Always check the specific tax laws for your state. Your best federal choice isn’t automatically your best state choice, and you don’t want to leave local savings on the table.

Ready to stop guessing and start maximizing your non-cash donation deductions? DeductAble uses AI to classify and value your donated goods accurately, creates year-end reports, and stores all your records securely. Turn your spring cleaning into significant tax savings. Download the app today at https://deductable.ai.