-

1/1/2026

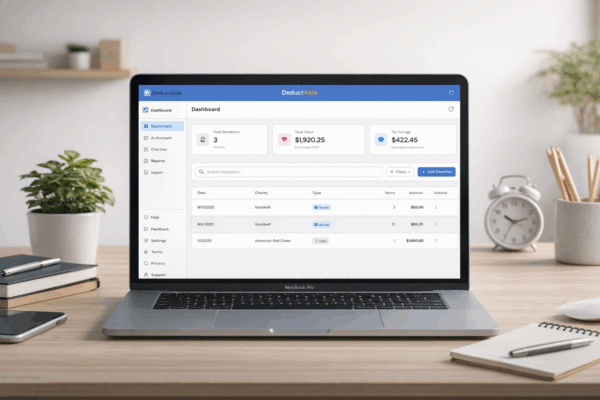

1/1/2026Introducing the DeductAble Web App

Great news for DeductAble users: You can now track your charitable donations directly from your web browser. Whether youre at your desk, on a Chromebook, or simply prefer a larger screen — DeductAbles full-featured web app is live and ready for you at app.deductable.ai. Why a Web App? Since launching DeductAble on iOS, one of

-

12/14/2025

12/14/2025Navigating the Noncash Charitable Contributions Limit

Donating things you no longer need is a great way to support the causes you believe in and maximize your itemized tax deductions. But to get the most out of your generosity at tax time, you need to understand the noncash charitable contributions limit. This isnt some arbitrary dollar amount. The IRS caps your deduction

-

12/5/2025

12/5/2025Are Funeral Expenses Tax Deductible?

Lets get straight to the point: funeral expenses are almost never tax-deductible on your personal tax return. The IRS sees these costs as a personal expense, plain and simple. That means you cant claim them on your Form 1040, no matter how significant the financial strain. Are Funeral Expenses Tax Deductible While you can’t write

10/22/2025

Understanding Goodwill Donation Receipts — and How DeductAble Makes Tax Deductions Effortless

Donating to Goodwill is one of the most rewarding ways to give back to your community — and it can also help reduce your taxable income. To maximize your Goodwill donation tax deduction, it’s crucial to understand how to document your gifts properly with a Goodwill donation receipt.

What Is a Goodwill Donation Receipt?

A Goodwill receipt or Goodwill Industries receipt serves as your official proof of donation. It typically includes the date, location, and a brief description of what you gave. The IRS requires this documentation to support your charitable deduction, especially for non-cash donations.

When you donate, always ask for a receipt at your local Goodwill donation center. Most locations provide a paper slip on the spot, while others may offer printable or digital forms through their website.

Why the Address Matters

Taxpayers often wonder, “What is the Goodwill Industries address for taxes?” or “Which Goodwill address for taxes should I use?” Each regional Goodwill operates independently, so you should record the exact address of the center where you donated. Listing the correct address ensures your paperwork aligns with IRS requirements and avoids confusion during filing.

The Challenge: Manual Tracking and Valuation

While a Goodwill tax receipt confirms your donation, it doesn’t include item values. Many donors lose track of what they gave or how much it was worth, leaving potential deductions on the table. Manually researching fair market values (FMV) and organizing receipts can quickly become frustrating.

The Solution: DeductAble

DeductAble transforms the way you manage non-cash donations. Instead of juggling paper receipts and spreadsheets, you can:

- Scan or upload your Goodwill receipt directly into the app — no manual entry required.

- Or even better, take a quick photo of your donated items — AI instantly recognizes categories (e.g., clothing, electronics, furniture) and assigns an accurate fair-market value based on IRS guidelines and real resale data.

- Automatically look up the correct Goodwill address for taxes or any other charity address within the app.

- Generate organized, IRS-ready summaries of your donations at tax time.

Make Every Goodwill Donation Count

Goodwill is a qualified 501(c)(3) organization, meaning your donations are eligible for tax deductions when properly documented. DeductAble ensures your generosity translates into maximum savings — making every Goodwill donation receipt easy to track, value, and use come tax season.

Take the hassle out of giving. Track, value, and document your Goodwill donations automatically at DeductAble.ai.