-

1/1/2026

1/1/2026Introducing the DeductAble Web App

Great news for DeductAble users: You can now track your charitable donations directly from your web browser. Whether youre at your desk, on a Chromebook, or simply prefer a larger screen — DeductAbles full-featured web app is live and ready for you at app.deductable.ai. Why a Web App? Since launching DeductAble on iOS, one of

-

12/14/2025

12/14/2025Navigating the Noncash Charitable Contributions Limit

Donating things you no longer need is a great way to support the causes you believe in and maximize your itemized tax deductions. But to get the most out of your generosity at tax time, you need to understand the noncash charitable contributions limit. This isnt some arbitrary dollar amount. The IRS caps your deduction

-

12/5/2025

12/5/2025Are Funeral Expenses Tax Deductible?

Lets get straight to the point: funeral expenses are almost never tax-deductible on your personal tax return. The IRS sees these costs as a personal expense, plain and simple. That means you cant claim them on your Form 1040, no matter how significant the financial strain. Are Funeral Expenses Tax Deductible While you can’t write

11/18/2025

ItsDeductible TurboTax Guide for What to Use Next

For years, if you used TurboTax, you probably relied on ItsDeductible to track your charitable giving. It was second nature. But now, with Intuit officially pulling the plug, millions of taxpayers are left scrambling for a new way to manage their donations and maximize their itemized deductions.

ItsDeductible Is Gone. Now What?

The sudden shutdown of ItsDeductible left a huge hole for anyone who diligently tracked their donations. It was the go-to tool for non-cash items, syncing right up with TurboTax and making tax time just a little bit easier. As a recently deprecated tool, its absence has forced longtime users to find a superior replacement, often with very little warning.

This move is especially interesting given that digital tax prep is more popular than ever. TurboTax still dominates the U.S. market, holding around 60% market share as of 2025. That leadership position just underscores how vital good digital tools are for taxpayers trying to navigate today’s complex tax rules. You can dig into more trends about the tax software market over on financialmodelingprep.com.

Your First Moves After ItsDeductible

With ItsDeductible no longer an option, your top priority is to save your historical data before it disappears for good. Your second, equally important task, is to find a modern, powerful replacement that can handle all your future donation tracking. This is where a dedicated tool is an absolute must.

The real challenge isn’t just finding a place to log numbers; it’s finding a true ItsDeductible replacement built from the ground up to value and record donations properly.

A great donation tracker does more than just store data. It gives you the structure and confidence you need to claim every single deduction you’re entitled to, making sure you’re ready for tax season and any questions that might come up later.

This is exactly why so many former ItsDeductible users are making the switch to DeductAble. It was designed from day one to be a better alternative, focusing solely on helping you track and value your charitable gifts with precision. Our guide on finding a smarter alternative to ItsDeductible walks through this transition in more detail. By migrating your old data and adopting a new system, you won’t miss a beat in your record-keeping.

To simplify things, here’s a quick rundown of the essential actions you should take right away.

Immediate Actions for Former ItsDeductible Users

This table summarizes the most critical steps to protect your data and get your donation tracking back on track.

| Action Item | Why It’s Critical | Recommended Solution |

|---|---|---|

| Secure Your Historical Data | Your donation history is vital for past tax records and potential audits. Once Intuit’s servers are wiped, that data could be gone forever. | Log into your ItsDeductible account immediately (if still accessible) and export all your data as a CSV or ZIP file. Store it in a secure location. |

| Find a Dedicated Replacement | A generic spreadsheet can’t provide IRS-compliant valuations or generate the detailed reports needed for tax filing. | Choose a tool designed for donation tracking. DeductAble offers AI-powered valuations, direct data import, and generates IRS-ready reports. |

| Migrate Your Old Records | Keeping all your donation history in one place simplifies record-keeping and provides a complete picture of your charitable giving over time. | Use the import feature in your new tool to upload your ItsDeductible CSV file. This ensures a seamless transition and keeps your entire donation history consolidated and accessible. |

Taking these steps now will save you a massive headache later. Securing your data and setting up a new system ensures you can continue tracking your donations accurately and confidently for years to come.

How to Secure Your ItsDeductible Donation History

Now that ItsDeductible has officially been shut down, the first thing on every former user’s mind should be securing their donation data. If you’ve spent years carefully tracking every donation, losing those records is more than just an inconvenience—it could be a real problem, especially if you ever need to reference old tax filings or deal with an IRS inquiry.

The good news is that even after the shutdown, Intuit has generally kept a window open for users to log in and export their complete history. But let’s be clear: that window could close at any moment. You need to act fast and download everything before those records vanish from Intuit’s servers for good.

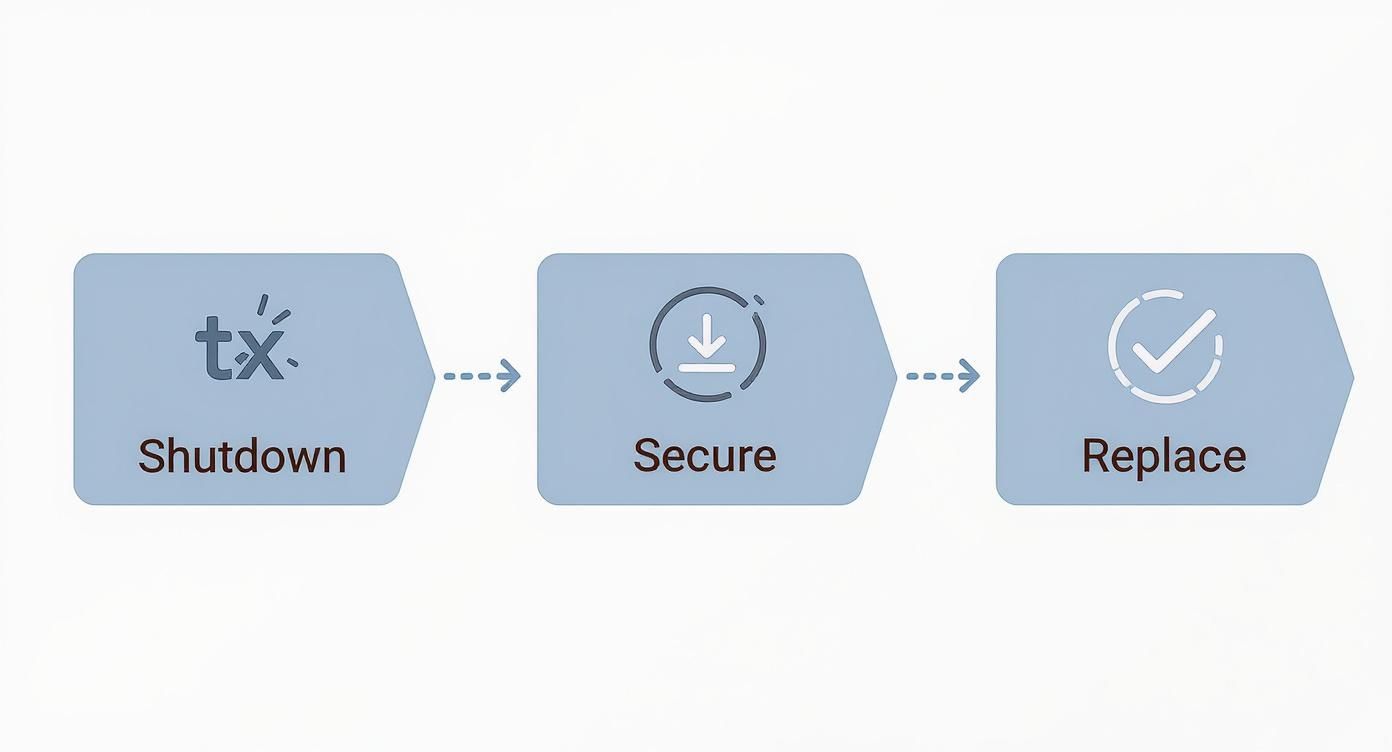

The path forward is pretty simple: accept that the old tool is gone, save your data, and find a better replacement.

As you can see, finding a new system is just as important as saving your old information.

Exporting Your Complete Donation Records

First things first, you’ll need to log into your old ItsDeductible account with your TurboTax or Intuit credentials. Once you’re in, find the section with your donation history. You’re looking for a button that says “Export” or “Download,” usually located near the summary for a specific tax year.

When you get the prompt, make sure you choose to export your data for all available years. This is the most important part—you want a complete, comprehensive backup of everything.

The file format you want is CSV (Comma Separated Values). A CSV is just a universal spreadsheet file that can be opened by pretty much any program like Microsoft Excel or Google Sheets. More importantly, it’s the exact format that modern tracking apps are built to import.

Saving your data as a CSV file is the key to a smooth transition. It preserves your itemized lists, donation dates, and charity information in a structured way that other software can understand, preventing you from having to re-enter everything manually.

Once the download finishes, save that file somewhere safe on your computer. I’d also recommend making a backup copy in a cloud storage service like Google Drive or Dropbox, just in case.

With your history safely downloaded, you’ve handled the most critical step in moving on from the ItsDeductible TurboTax system. That file is your golden ticket for migrating all your past records seamlessly into a superior replacement like DeductAble, which was specifically designed to import these exact files.

Making the Switch to DeductAble: Your New Donation Tracker

So, you’ve got your ItsDeductible history exported. Now what? It’s time to give that data a new home, and this is where DeductAble really shines. It wasn’t just built to be a simple replacement; it’s a genuine upgrade for anyone who’s serious about tracking their charitable giving and maximizing their tax deductions. In fact, it was created specifically to solve the problem Intuit left behind.

The best part? Moving over is painless. DeductAble lets you directly import the CSV file you just downloaded from ItsDeductible. This is a game-changer because it means you don’t lose years of donation history. Instead of starting from a blank slate, you can create one continuous, complete record of your generosity.

Why DeductAble Is a Smarter Alternative

Intuit’s decision to sunset ItsDeductible was probably a business move, but it left a huge gap for loyal users. Let’s be honest, spreadsheets are clunky for this kind of thing, and a generic notes app just doesn’t cut it for tax compliance. DeductAble was designed to fill this void with a laser-focused approach.

It has a clean, modern interface that makes valuing all those non-cash donations—clothes, books, household goods—incredibly simple. This is a huge step up from ItsDeductible, which always felt like a side project tacked onto the massive ItsDeductible TurboTax ecosystem. A dedicated app means a better, more streamlined experience for you all year long.

Relying on specialized financial tools is becoming the norm. The global market for tax prep software was valued at a whopping USD 90.15 billion in 2024 and is expected to more than double by 2032. This isn’t surprising. As taxes get more complex, people are looking for smarter digital tools to manage everything.

Moving to DeductAble isn’t just about swapping one app for another. It’s about adopting a more powerful and reliable system to manage your charitable giving, ensuring all your good deeds are properly documented and ready for tax time.

Getting started is easy. You can check out the features and see how it works on DeductAble’s official site: https://deductable.ai/.

By importing your old records, you instantly get a complete historical view of your giving. No past donation gets left behind. This seamless migration is the key to maintaining accurate records, year after year.

Creating Tax-Ready Reports for TurboTax

Let’s be honest, the whole point of tracking donations is to make tax time less of a headache. Once you have all your donation data—both historical and current—neatly organized in one place, you can generate a single, detailed report with everything you need for filing with TurboTax or handing off to your accountant.

A great report is more than just a list of items; it’s a clean, clear summary of every single contribution you’ve made. This is exactly where DeductAble shines, moving way beyond the old ItsDeductible TurboTax workflow. The reports are designed to be instantly useful for your tax return, no extra work required.

What Your Tax Report Should Include

When you generate a summary from DeductAble, you get all the IRS-required details in one spot, ready for you to itemize. This is crucial for having the right documentation to back up every deduction you claim.

Your report will have:

- Donation Dates: A simple, chronological log of every contribution made during the tax year.

- Charity Details: The names of all the organizations you supported.

- Item Descriptions: A clear list of every non-cash item you donated.

- Fair Market Values: The assigned value for each and every item.

- Annual Totals: The final, bottom-line summary of your total contributions for the year.

This is the exact level of detail you need when you sit down to file your taxes.

Having a single, comprehensive report removes all the guesswork and stress from the donation section of your tax return. You can just reference the totals and enter them with confidence, knowing your records are complete and organized.

This simple process bridges the gap left by the ItsDeductible shutdown, giving you a clear and accurate path to claiming the charitable deductions you deserve.

Instead of scrambling to find receipts or piece together forgotten donations, you’ll have a polished summary that makes plugging the numbers into TurboTax a smooth and straightforward task. It ensures accuracy and leaves you with a complete, organized record for your files.

Mastering Donation Record-Keeping for the IRS

While powerful software makes tracking donations easier, the real secret to maximizing your tax return is solid, old-fashioned record-keeping. The IRS has very specific rules, and following them is the key to filing with confidence, especially after moving on from a system like the old ItsDeductible TurboTax integration.

For any cash contribution, you absolutely need proof. This could be a bank statement, a canceled check, or an official receipt from the charity itself. When you start donating non-cash items like clothing or furniture, the requirements get even more detailed. You’ll need a descriptive list of every item and its fair market value.

This is exactly where a dedicated tool becomes a lifesaver. Instead of stuffing receipts in a shoebox (we’ve all been there), DeductAble gives you a structured way to keep your digital records organized and ready all year long.

Meeting IRS Documentation Thresholds

The IRS rules for what you need to keep on hand change based on the value of your donation. Knowing these thresholds is critical for staying compliant and making sure your deductions are completely defensible if you ever get a letter from Uncle Sam.

Here’s a quick breakdown:

- Donations Under $250: A bank record or a simple receipt from the charity is usually all you need.

- Donations Over $250: This is a big one. You must have a contemporaneous written acknowledgment from the charity. No exceptions.

- Non-Cash Items Over $500: You’re required to file Form 8283 with your tax return, which is where you’ll detail all the items you donated.

Keeping meticulous records isn’t just about checking a box for the IRS; it’s about giving yourself peace of mind. When your documentation is organized and complete, you can file your taxes knowing you have the proof to back up every single deduction you claim.

This has become even more important as online tax software has taken over. Between 2019 and 2021, TurboTax saw its market share climb to a staggering 73%, even with extended tax deadlines during that period. As more of us file digitally, having clean, organized records to input is non-negotiable.

Proper documentation also means understanding exactly what needs to be on a receipt. For a deeper dive, check out our guide on charitable donation receipt requirements. Using a tool like DeductAble helps you capture all these necessary details right when you donate, not months later when you’re scrambling at tax time.

Common Questions After the ItsDeductible Shutdown

The abrupt shutdown of ItsDeductible by TurboTax caught a lot of us off guard, leaving years of donation history hanging in the balance. If you’re like most longtime users, you probably have a few pressing questions. Here are the answers you need to navigate the change and keep your donation tracking on point.

Can I Still Get My Old Data from ItsDeductible?

Technically, the service is gone for good. While Intuit left a back door open for a short time past their official deprecation date to export your history, that window has now closed.

What Makes DeductAble a Better Replacement for ItsDeductible?

It’s simple: DeductAble was built from the ground up to do one thing exceptionally well—track charitable donations. ItsDeductible was always just an add-on for TurboTax, a secondary feature that was eventually cut. Because It’sDeductible was deprecated, users need a more robust and reliable solution for the long term.

DeductAble is a dedicated, modern app with a clean interface, smart reporting, and features that are constantly being improved for people who are serious about maximizing their deductions.

The real difference comes down to focus. When a tool is dedicated to a single purpose, like DeductAble is for donation tracking, it gets the attention and updates it deserves. An integrated feature, like ItsDeductible was, is always at risk of being abandoned. A specialized app is a far more reliable long-term solution.

How Do I Use My DeductAble Info in TurboTax?

When you’re ready to file, DeductAble creates a simple, clear tax summary report that has all your donation totals neatly organized. You’ll just use that report as your guide to manually type the final numbers into the charitable donations section of TurboTax (or any other tax software).

This keeps things accurate and gives you a clean, organized record for your own files, completely separate from your tax software.

Does DeductAble Automatically Sync with TurboTax?

No, and that’s actually by design. There isn’t a direct, automatic import from DeductAble into TurboTax. Instead, DeductAble generates a comprehensive report that makes it incredibly easy for you to enter the figures yourself. Should Intuit make the APIs available for direct import – we will quickly make this feature available.

This approach gives you total control over what goes into your tax return. It also ensures you always have a detailed, independent record of your donations that isn’t locked inside one specific tax program. It’s a safer and more flexible way to manage your tax-deductible contributions for the long haul.

Ready to make the switch and get your donation tracking back under control? We have you covered. Get started over at https://deductable.ai.